Last summer, the FCA published guidelines for its new Consumer Duty, a package of measures designed to re-centre customers within financial firm operations. Now, with less than 6 months until the compliance deadline, organisations need to get to grips with the requirements – fast.

What is Consumer Duty?

Consumer Duty is about putting customers first and shifting the burden of harm prevention onto firms.

It consists of a new Consumer Principle – an overarching standard of conduct as to what the FCA expects from firms. And it has 4 outcomes for key areas of the consumer-firm relationship.

Consumer Duty is a broad, wide-reaching regulation, but at its heart, it’s about protecting customers from financial harm. Financial services organisations must not only foster positive outcomes for their customers, but they must also proactively measure and monitor those outcomes to keep customers safe.

The compliance challenges: Are all rooted in data and operational silos

Consumer Duty puts the onus on financial institutions to be proactive and holistic in their approach across the customer lifecycle. However, many firms operate in silos, preventing them from having a clear picture of their customers, operations and risks.

These silos happen because the many areas collecting customer data are isolated from one another, both from operational and technological standpoints.

As a result, the organisation has:

- A fragmented experience that forces customers to ‘start again’ every time they enter a new channel or process

- Operations that can never fully identify areas of risk and opportunity

- An inability to achieve Consumer Duty compliance because it can’t visualise – let alone promote – those positive customer outcomes

The solution: Audit your systems and orchestrate your data

The size of firms, the complexity of legacy tech and the sheer volume of data mean breaking down these silos isn’t easy. But it’s possible – and it’s essential.

The first step is to thoroughly audit all internal systems, so you can identify the touchpoints where data accumulates. Once you know what you’re working with, stakeholders from across the business can collaborate to reconcile any discrepancies and create a single source of truth. This first step is as much about people as it is about processes and systems because breaking down silos requires an element of cultural change – a willingness to give up ‘ownership’ of individual areas and a belief in the power of coming together.

The second step is to partner with an expert in data visualisation and customer journey mapping to help you plan how to unify the data and processes identified in the audit. Tools like Engage Hub’s Customer Journey Tracker can help you pull together a unified view of every customer touchpoint and associated data, giving you invaluable insights into customer behaviour.

Technology is essential

Consumer Duty compliance is impossible without a holistic view of your data and customer journeys. Until you understand exactly what’s happening at every touchpoint along those journeys, you can’t be proactive in your approach.

Technology, and the right technology partner, can help you create that unified view, opening up a world of possibilities for customer experience improvements and streamlined Consumer Duty compliance. But you need to act fast to be ready for the July deadline.

Get support now

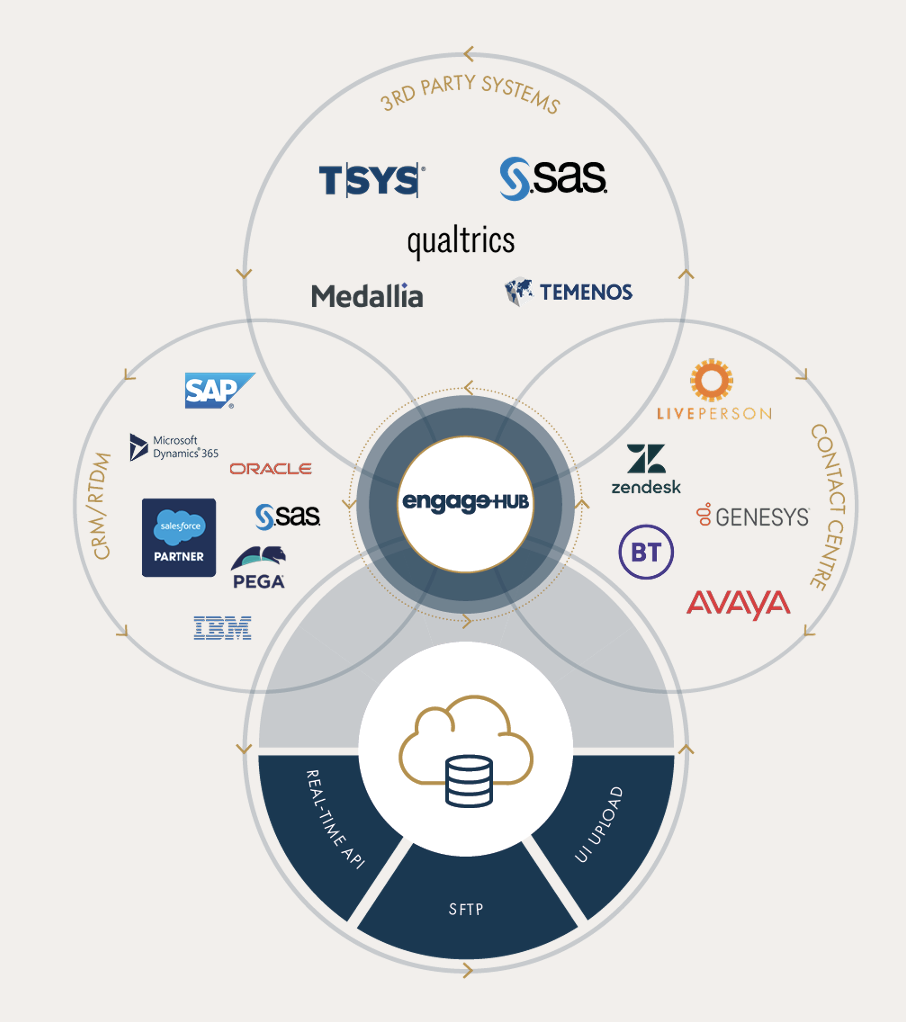

Engage Hub orchestrates data from your existing systems, giving you a single version of the truth with centralised data from all touchpoints – without changing your existing technology stack.

We have pre-built integrations to the solutions you already use, such as MS Dynamics 365, Adobe, BT, IBM, SAP, Cisco, Avaya, Genesys, Zendesk and more. As a strategic partner of Salesforce and Medallia, we help you benefit from integrated functionality that contributes towards more effective customer service – and streamlined Consumer Duty compliance.

–

For more about how we can help you meet the FCA’s Consumer Duty deadline, get in touch today or watch our on-demand webinar for more detailed insights.